In 2009, we published the Bernard Paradox: large organisations consolidate because they must, yet at the same time their markets fragment because they can. What we postulated back then is now an everyday reality.

Back then, our own Paradox became our raison d’être: since 2009, we have provided our clients with the tools and processes to beat the fragmentation trap, updating and redesigning them ahead of the curve, as hardware and software innovation allowed.

- Consolidation continues because financial markets reward improvements in operating margin, resulting in relentless pressure on direct cost as well as on overheads.

- Yet at the same time, fragmentation continues as smaller manufacturers and retail operators now effectively compete, since their Minimum Efficient Scale continues to go down.

- As a consequence, the nature of competition has radically changed: what used to be one market, is now an aggregation of hyperlocal playing fields.

- With fewer people having to manage more complexity, Maximum Efficient Scope© has become a critical organisational bottleneck.

Over the last decade:

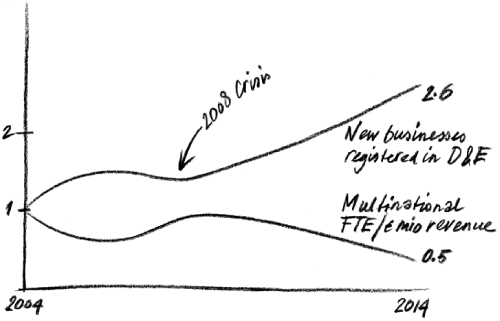

- headcount per million EUR revenue halved for the multinational CPG companies we surveyed(1),

- yet at the same time the number of new businesses entering the market place each year has more than doubled in the developing world(2), enabled by radical reductions in barriers to entry.